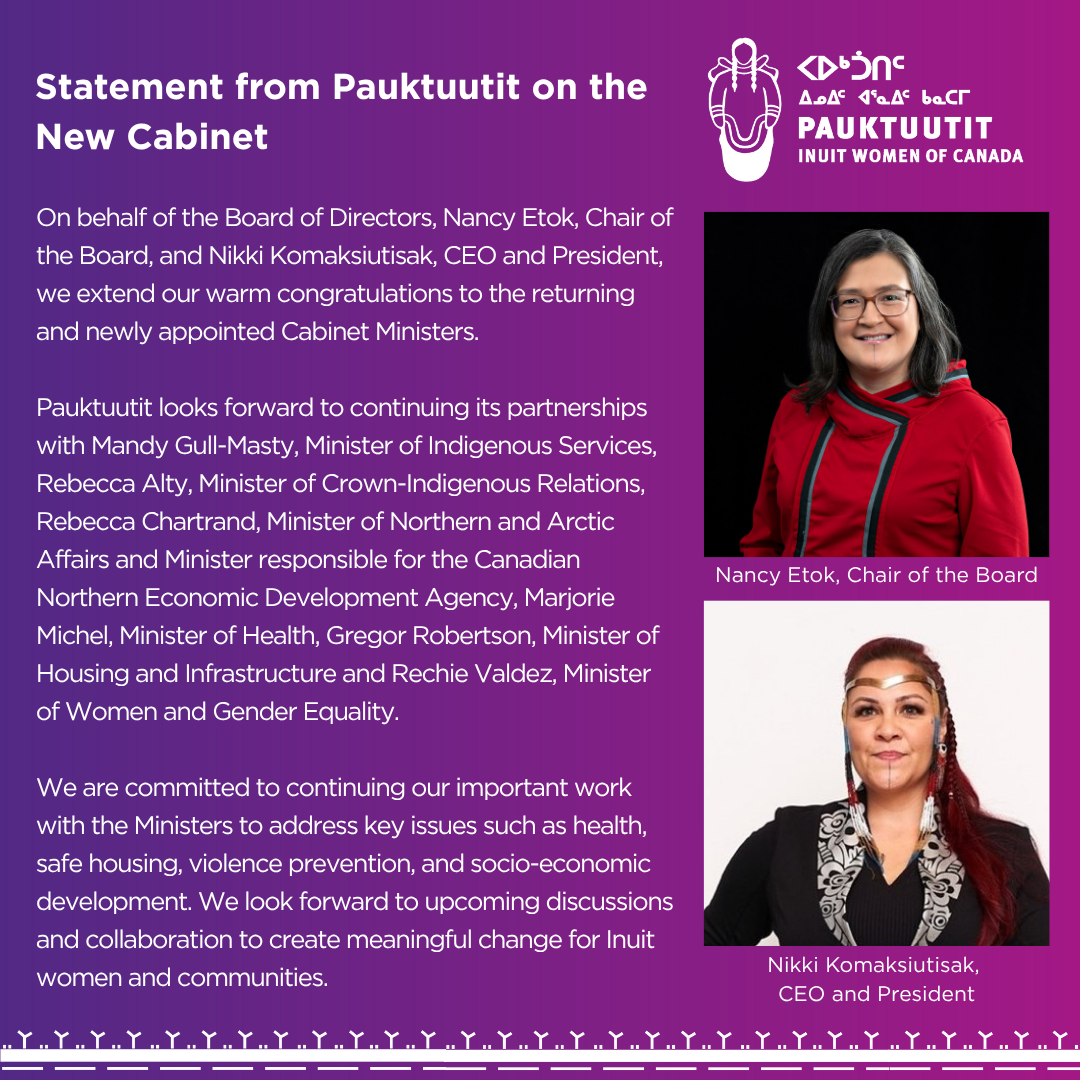

National Voice of

Inuit Women in Canada

Pauktuutit Inuit Women of Canada advocates for the rights, safety, and well-being of Inuit women, children, and gender-diverse Inuit through policy development, research, and partnerships. Guided by Inuit Qaujimajatuqangit, we drive change through policy, research, and partnerships to support thriving Inuit communities.

Advocacy

We advocate for equality, social improvements and greater awareness of our needs with a focus on four key areas.

Health

Learn more

Poverty Reduction

Learn more

Safe & Appropriate Housing

Learn more

Violence Prevention & Justice

Learn more

Foundations

Our work is rooted in the lived experiences, knowledge, and priorities of Inuit women, children, and gender-diverse people. We work to address systemic inequities through a framework that reflects Inuit values, rights, and historical realities. Our approach recognizes colonization as an ongoing structure and pushes for systemic change by applying an Inuit-specific Gender-Based Analysis+ (ISGBA+), Inuit Qaujimajatuqangit, and the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP).

Priorities

At Pauktuutit, we aim to eliminate barriers to healthcare, address high rates of violence against women, and promote poverty reduction initiatives. By emphasizing the importance of safe housing as a fundamental human right, we strive to create a future where all Inuit can thrive.

56%

Over 56% of Inuit lack regular access to healthcare providers, leading to evacuations and exposure to systemic racism.

13x

Violent crime rates against women in Nunavut are 13 times higher than the Canadian average.

76%

76% of Inuit aged 15 and over in Inuit Nunangat experience food insecurity

60%

60% of communities in Inuit Nunangat do not have shelters for women and children facing violence.